Table of Content

Real estate can provide a steady income stream from rents, and any rental income you collect grows tax-free within the IRA. You can hold real estate in your IRA, but you'll need a self-directed IRA. Tim enjoys researching and sharing his knowledge on the topics of banking, retirement and medicare through his writing. If you're tired of solely depending on your job for family income, click here now and learn why our income is increasing despite the financial crisis and how we're making our dreams come true. The term ancestor, as used by the IRS, essentially means any direct descendant from great, great grandparent to great, great grandchild. In essence, the person in question must be a direct line descendant of you or your spouse.

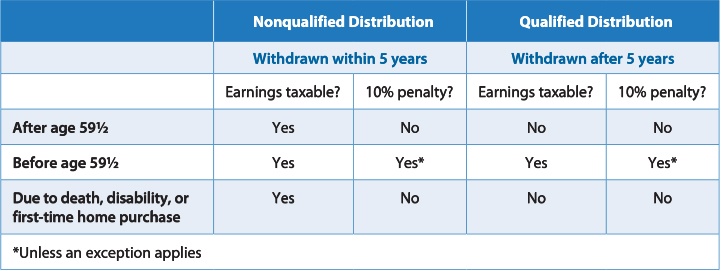

But such withdrawals won't constitute a Roth IRA first home purchase distribution, they'll just be regular tax-free withdrawals. You can pull out up to $10,000 of investment earnings to put toward your first home, but you’ll pay income taxes on the distribution. Even though you'll avoid the 10% early withdrawal penalty on the money, you'll still owe income tax on any amount you withdraw.

Meet Your Instructors

There is no tax or penalty, and you can use the money however you like. • You can also use the money to help fund the purchase of a home for your child, grandchild, or parent who qualifies as a first time home buyer. After five years, you can withdraw all of your contributions and up to $10,000 of your investment earnings—but you might not have earned that much yet. Having a tax-free source of income in retirement can be incredibly beneficial.

If you’re considering taking money from your Roth IRA to fund a home purchase, consider how much you might need that money later on. If you are 59 ½ or older, you can withdraw penalty-free at any time. Once you reach age 72 (the law was recently changed from age 70 ½), you’ll have to take a required minimum distribution each year. In the video above, IRA Financial’s Adam Bergman gives a great example of how saving just a few dollars a day can add up.

Find and Purchase Your Home

Although using money from your Roth IRA may seem like an easy source to fund a down payment to purchase your first home, it might not be the right decision for everyone. Before you cash out your Roth IRA, think about how it might broadly impact your financial future. You can withdraw from the contributions you have made into your Roth IRA at any time, for any reason.

Consider working with a financial advisor as you explore home ownership. Unlike other types of retirement plans, once you reach age 59 ½, you can withdraw your contributions without tax or penalties at any time you’d like for any reason. For a younger person, the $10,000 penalty-free exception to purchase a first home provides an additional resource for a down payment or other homebuying expenses. While the primary purpose of a Roth IRA is for retirement savings, it has a provision for early withdrawals that are exempt from penalties when there is "immediate and heavy financial need". Costs directly related to the purchase of a primary residence is a qualifying exemption, according to the Internal Revenue Service. Other qualifying exemptions include medical costs, tuition, payments to prevent eviction, funeral expenses, and damage to a principal residence.

Qualified Withdrawals Are Tax-Free

These include qualified higher education expenses, some medical costs, and other hardships. Be sure to consult with your tax professional to clarify any of these exceptions before you move forward. Consider things like the location and housing market where you plan to buy.

While Roth IRAs are designed primarily for retirement savings, you can also withdraw up to $10,000 of your account’s earnings for a first-time home purchase. You can also use that money to build or rebuild a first home. Note that the IRS will consider you a first-time homebuyer if you and your spouse haven’t owned a home that you use as your main residence in the past two years.

True, first-time homebuyers are exempt from the 10% penalty—but you can only use $10,000 of your IRA for that. Since you have to take out the funds anyway, doing so to purchase property may not be the worst idea, especially if it means that you can make a bigger down payment or perhaps even buy the place outright. Still, the SECURE Act doesn’t specify any sort of schedule. You can prorate distributions over the decade or withdraw everything in a lump sum in one year.

It’s also worth noting that traditional IRAs also qualify for a first time home buyer exception. This exception allows for up to $10,000 to be withdrawn from the IRA before the age of 59 ½, to purchase a house as a first time home buyer and avoid penalties. Traditional IRAs are funded with pretax or tax deductible dollars, meaning that you don’t pay taxes on the income that you put into your IRA. When you retire and begin taking money out of the account, you’ll pay regular income tax on your withdrawals . Lastly, if you chose the Roth IRA route, you can always self-direct the plan. This means you can invest in virtually anything you want with your retirement funds.

You’ll likely have to pay in cash, which takes a big bite out of the account and affects your rate of return down the road. These costs include things such as a down payment, financing related costs, closing costs, and other expenses directly related to the purchase of a first home. These expenses do NOT include upgrades or improvements to an existing first home or paying down a mortgage on an existing home.

The average rate on a conventional 30-year mortgage is about 3%, according to Bankrate.com. "These accounts are designed to help people accumulate as much money as possible for retirement," said CFP Shon Anderson, president of Anderson Financial Strategies in Dayton, Ohio. The average rate on a conventional 30-year mortgage was just under 3% on July 31, according to NerdWallet.com. Once you know roughly how many years it will be before you buy a home, choose an appropriate mix of stock and bond funds.

Before you can withdraw funds, they must also be available in cash, so you may need to liquidate some of the investments you have inside your account. The total amount of withdrawals from a traditional IRA are subject to ordinary income tax, regardless of the account holder's age. Up to $10,000 in Roth IRA earnings can be withdrawn — free of both taxes and penalty — for a home purchase if you meet certain requirements. It’s essential that you’re able to continue saving for retirement once you’ve bought your first home. When you buy your first home, you’re likely making the biggest purchase of your life. It may be tempting to take money from your Roth IRA, but you should think carefully about your financial situation before you tap into your retirement funds.

The main distinction is that you contribute after-tax dollars to a Roth IRA because contributions are not tax deductible. Additionally, if you don’t qualify for the first-time home buyer exemption, you’ll have to pay the hefty 10% penalty on your withdrawal in addition to regular income tax. Using a Roth IRA to buy a house is just one reason to save in this unique retirement plan.

Account holdings are for illustrative purposes only and are not investment recommendations. In this case, income tax will likely need to be paid but qualifying withdrawals won’t be subject to the additional 10% early withdrawal penalty. Financial and retirement goals are deeply personal, as are the amount of money an individual is able to save each month. For most people, taking money out of a retirement account early will hinder their progress.

You’ll pay interest on the loan, typically the prime rate plus one or two percentage points, which will go back into your 401 account. In most cases, you have to repay the loan within five years. But if you're using the money for a house, the repayment schedule may be extended to as many as 15 years. If you qualify as a first-time homebuyer, you can withdraw up to $10,000 from your traditional IRA and use the money to buy, build, or rebuild a home.

No comments:

Post a Comment